Owning a car in Cambodia is no longer just a luxury; it has become a necessity for many families, professionals, and business owners. Whether you need a vehicle for commuting to work, managing your business, or traveling with family, having your own car brings convenience and freedom. However, buying a car outright with cash is not always realistic, especially as car prices continue to rise. That’s why many people are turning to a car loan to finance their purchase. If you are searching for a car for sale in Cambodia, understanding how to finance it smartly can save you money and stress.

Why Choose a Car Loan in Cambodia?

A car loan is a financing option that allows you to buy a vehicle and pay for it over time through monthly installments. Instead of waiting years to save the full amount, you can own your car immediately while repaying gradually. Some of the main advantages of taking out a car loan include:

Lower upfront payment: You only need to cover the down payment, usually between 10% and 30% of the car’s price.

Flexible terms: Depending on the lender, you may choose repayment periods ranging from one year up to seven years.

Access to better cars: Financing allows you to consider newer or higher-quality models that may be out of reach if paying cash.

For anyone exploring a car for sale in Cambodia, these benefits make financing a practical solution.

Where to Find Car Loans in Cambodia

When looking for financing, there are several options available in Cambodia:

Banks – Major banks in Cambodia provide competitive car loan programs. They usually require proof of income, employment verification, and sometimes collateral. Their advantage is relatively lower interest rates and structured repayment plans.

Microfinance Institutions (MFIs) – MFIs are popular for individuals who may not qualify for bank loans. They tend to approve applications faster and with fewer requirements, though interest rates are often slightly higher.

Dealership Financing – If you are browsing a car for sale in Cambodia through a dealership, many sellers offer in-house financing options. This is convenient because you can select and finance the car in one place. However, you should carefully compare their rates and repayment conditions.

How to Apply for a Car Loan

Applying for a car loan is a straightforward process if you are prepared. Here are the typical steps:

Research and Compare Lenders

Don’t rush into the first offer. Compare banks, MFIs, and dealerships. Pay close attention to the interest rate, repayment term, and any hidden charges.

Choose the Right Car

Before applying, decide on the type of car you want. The Cambodian market offers a wide range of options, from budget-friendly used vehicles to brand-new luxury cars. Websites and local showrooms listing cars for sale in Cambodia are good places to start.

Prepare Documentation

Lenders usually request:

- National ID or passport

- Proof of income (salary slip, employm ent letter, or business license)

- Address verification

- Sometimes guarantors or collateral

Make the Down Payment

Most institutions require you to pay an initial amount upfront. This percentage depends on the lender and the car’s price.

Sign the Agreement

Carefully review the loan terms before signing. Understand your monthly installment amount, repayment period, and penalties for late payments.

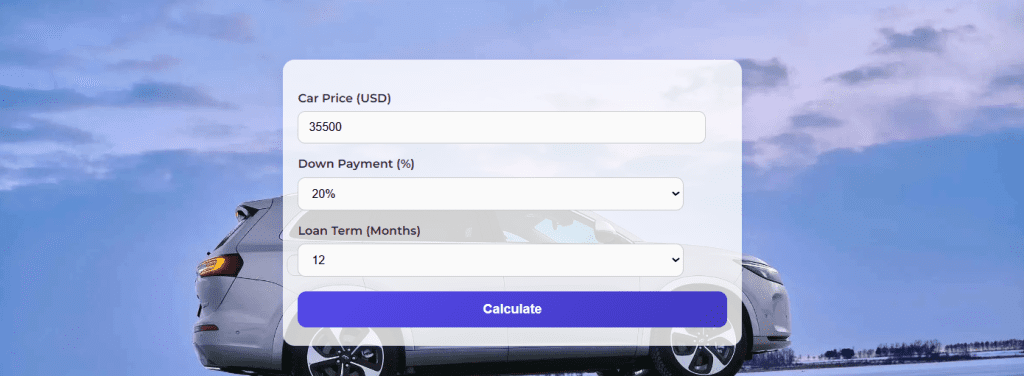

Using a Car Loan Calculator

One of the smartest steps before committing to financing is to use a car loan calculator. This tool helps you estimate your monthly payments based on the loan amount, interest rate, and repayment term.

For example, if you are considering a $20,000 vehicle, a car loan calculator can show you how much your monthly installment would be at different interest rates and loan periods. This helps you plan your budget, compare lenders, and avoid financial surprises.

If you’re searching online for a car for sale in Cambodia, it’s a good idea to use a car loan calculator alongside price listings to check what fits your income level.

Tips for Managing Your Car Loan Wisely

- Budget realistically: Make sure your monthly payment does not exceed what you can comfortably afford.

- Avoid late payments: Missing payments can damage your credit profile and lead to additional fees.

- Consider insurance: Some lenders require full insurance coverage on financed cars, which adds to your total cost.

- Shop smart: Compare several cars for sale in Cambodia to ensure you’re getting good value.

What to Consider When Buying a Car in Cambodia

The Cambodian car market is diverse, offering everything from second-hand Japanese imports to brand-new SUVs. When making your choice, consider:

Condition: Used cars are cheaper but may require more maintenance.

Fuel efficiency: With rising fuel costs, efficient vehicles can save money in the long term.

Resale value: Some brands hold their value better, making them a safer investment.

Service availability: Choose a car with accessible spare parts and reliable service centers in Cambodia.

Conclusion

Financing a vehicle in Cambodia has never been easier, thanks to the variety of banks, MFIs, and dealerships offering car loans. Whether you are browsing for a brand-new SUV or a reliable second-hand sedan, exploring cars for sale in Cambodia is much more manageable with the right financing plan.

Before making your decision, use a car loan calculator to estimate your repayments, compare loan offers, and choose a car that fits both your lifestyle and budget. With the right preparation, you can drive away with confidence knowing that your car loan is manageable and your investment is worthwhile.